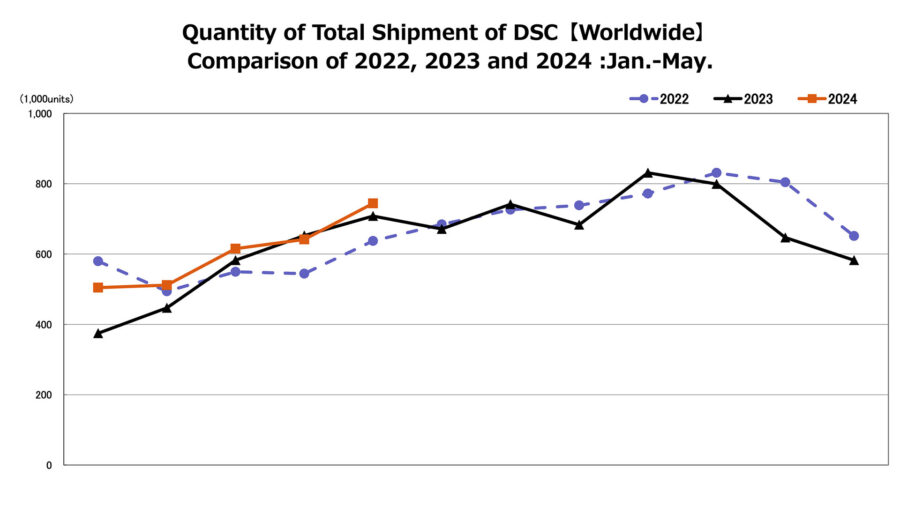

CIPA 2024 numbers for January-May 2024 indicate an interesting trend: the first half of 2024 is shaping up to become the best in a long time regarding gear sales. Overall, better figures from interchangeable cameras join a rise for compact, built-in lens cameras to provide the industry with the best sales figures for the last three years. These optimistic numbers need some broader context, so please read on – the plot thickens.

CIPA, the Camera and Imaging Products Association collects and publishes camera sales figures from multiple manufacturers, including the most significant players in the hybrid camera market. These figures may provide some interesting insights regarding the state of the imaging market, but as with all statistics, they should be approached with a sense of criticism and a bit of caution. Many different factors may affect the numbers.

Methodology – what is measured and how it’s counted

CIPA counts camera sales in both units and sale value. The numbers are divided into different segments such as DSLR, Mirrorless, respective lenses, built-in lens camera vs. interchangeable lens camera. CIPA uses the term “DSC,” which stands for Digital Still Camera, a term that probably covers most hybrid cameras. While cine gear is not included in these figures, it’s mostly the same manufacturers who make these cameras, the same mounts used across the systems, etc. A successful still-hybrid market will surely project on the Cine segment.

May 2024 figures

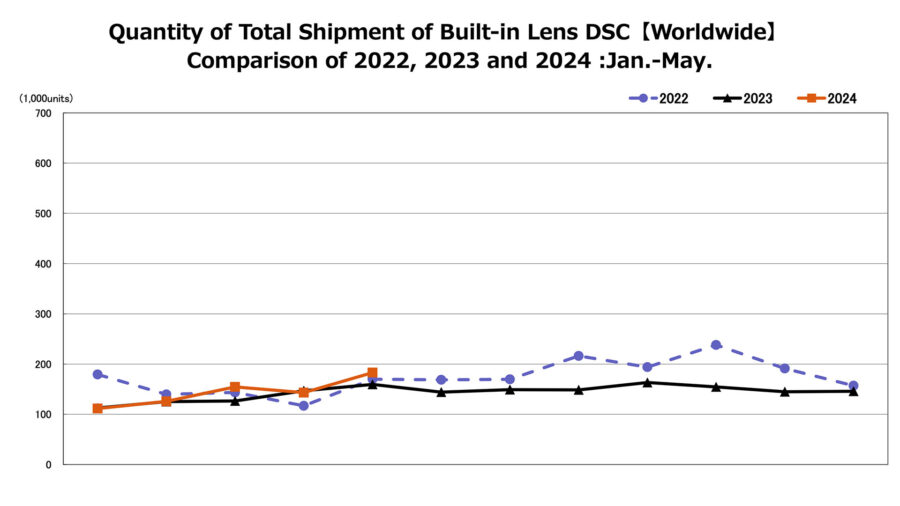

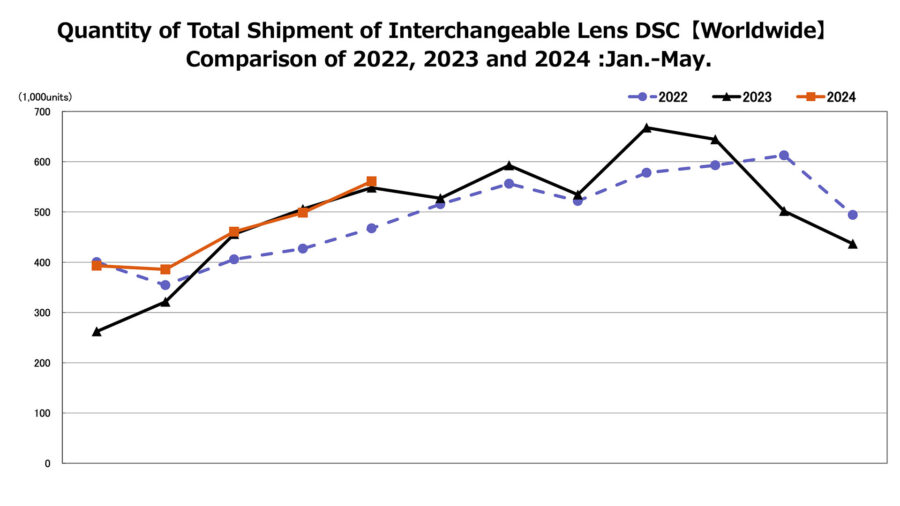

CIPA 2024 numbers reveal some interesting figures: 2.3 million interchangeable lens cameras were shipped in May 2024. This number represents a 9.8% rise over the corresponding period last year and an 11.9% rise over May 2022. Compact cameras saw a 7% rise over 2023. It may have something to do with the release of the FUJIFILM X100VI, one of the most preordered cameras in recent years, but we can only assume this since brand-specific figures are undisclosed and the X100VI is still not fully available at leading vendors like B&H.

Filmmaking for Photographers

In terms of sales value, ILC (interchangeable lens camera) sales grew by 28.6% compared with May 2023, clocking in at around 1.6 billion USD. Impressive as it is, it’s the value of built-in lens cameras that really exploded, with a whopping 34.7% rise (a total of 233 million USD). This further strengthens the theory regarding the FUJIFILM X100VI effect.

Are cameras becoming pricier?

As our eagle-eyed readers can probably tell, the rise in sales value dwarfs the rise in unit sales. This may suggest rising prices. I’ll argue that it’s not that cameras are getting pricier, it’s that the pricier cameras are gaining popularity over the more affordable ones. In my opinion, the blame lies with the significant improvements in smartphones over recent years. When the camera in your pocket is that good, you’ll need to significantly up your game to surpass it. This means better, pricier cameras and lenses.

DSLRs are not dead (but we’re getting there)

The numbers are quite decisive: mirrorless cameras count for 83.7% of ILC units shipped and 92.9% of the sales value. This is an ongoing trend, and I believe the recent introduction of Canon’s APS-C EOS-R line, as well as SIGMA’s mirrorless optics, greatly contributes to it. Last week, we saw the announcement of Canon’s first hybrid mirrorless flagship camera, the EOS R1. With shipments planned for November and a relatively low unit count, this camera may not have a significant effect on the numbers, but it represents a benchmark – each and every DSLR segment, for all major manufacturers, is now overthrown by Mirrorless.

Seems optimistic – where’s the catch?

While rising numbers are optimistic, the photo-video gear market is but a shadow of its former volume. The annual figures for 2021-2023 represent a constant rise to about 6 million cameras and 9.6 million lenses shipped in 2023. But this rise is only relative to the post-COVID era. In 2018, shipped unit figures reached 10 million camera bodies and 18 million lenses. We can’t quite estimate the effect this decline has had on us, but we should be aware of the challenges faced by top manufacturers in recent years.

Do you feel any effect from these numbers as a filmmaker? Do you think the industry is recovering from COVID-19, or is it just a flux in the general decline? What other insights can you extract from the data? Let us know in the comments.